Cash Flow Lending

Same day/next day cash service. Your business can borrow up to a months’ revenue and there are no early repayment fees. Also known as a revolving credit facility or retail finance / bridging loans.

Generally the interest rates are higher than asset lending; because it’s unsecured. However, digitalisation reduces the cost of the lending, so it’s still cheaper than the banks.

Alternative funders integrate online selling accounts like Amazon and Ebay to their analysis algorithms, enabling revolutionary approval processing and simple application forms. Interest rates can be as low as 1.5 - 4.5% per month. You need some kind of trading history to apply here - at least 6 months and an ‘ok’ credit score for approval.

Cash flow lending is a quick solution.

Basically some smart guys created online algorithms to speed things up... It’s called cash flow lending and it’s very different to traditional banking loans.

How can it be so fast?

Unlike other loans this is done entirely online, followed by a short confirmation phone call. Seamless integration by linking online seller accounts through pioneering verification techniques.

15 minute signup.

(Cash in account within a few hours)

How does the repayment work?

No early repayment fees which means the time you agree to pay back the money is the maximum (usually 6 months). You’ll be charged by the day so most companies repay early. Commercial minded account managers take time to understand the way you trade.

Some variations of cash flow lending enable repayments direct from your payment processor in real time (10-15% per sale).

Q: What are the rates?

A: 2.5%-5% (per month)

It’s more expensive but there’s nothing to keep or maintain so all pricing is transparent. You need to have been trading for at least 6 months. Being unsecured means it’s a higher risk to lend as there’s no security just a directors guarantee.

What's it used for?

Unexpected Tax Bills

Emergencies

Buying Stock

Opportunities

Paying Staff

Kitchen Sinks

Property Refurb

Safety Net

Cash Flow Lending via

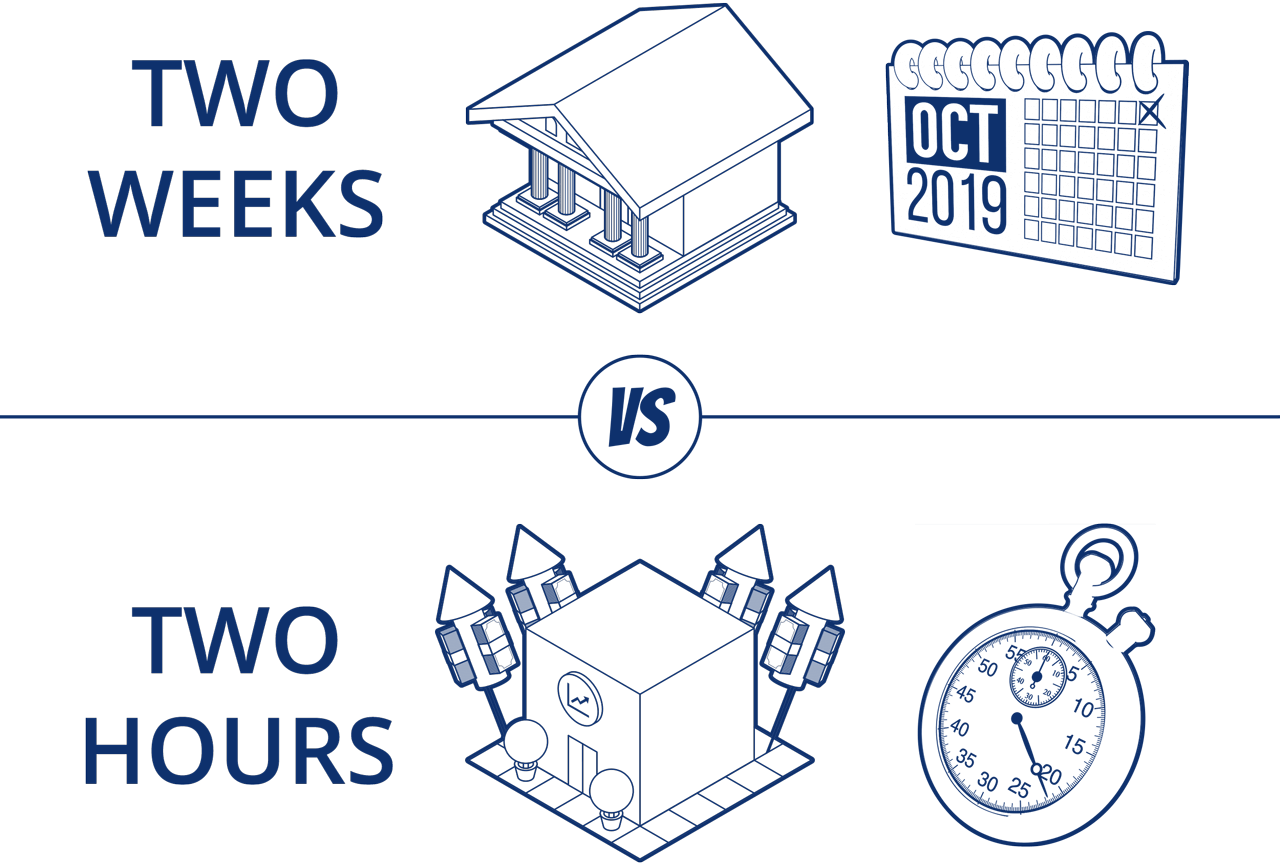

Traditional Business Banking

Simple business lending, overdrafts and revolving credit facilities from banks is down over 50% in four years. Application takes at least three weeks. Cash Flow Lending via

Alternative Business Banking

Efficient application process. Takes an hour in many cases. No early repayment fees. A different league of lending.

Get in touch

Talk to us about any of our products – no obligation.

020 8067 1369

[email protected]